Executive Summary:

This whitepaper presents an overview of the Odoo Payroll Module, a solution designed to streamline and optimize an organization's human resources and payroll operations. Our analysis demonstrates that the module's seamless integration and customizable functionalities lead to significant improvements in efficiency, accuracy, and compliance.

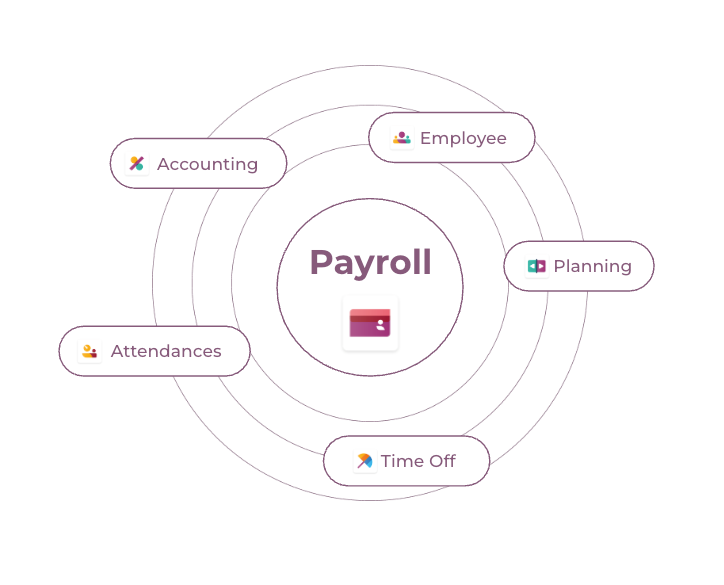

The unparalleled strength of utilizing Odoo for payroll lies in its native integration with a comprehensive suite of HR-related modules. Features from the Shift Planning, Attendance, and Time Off applications seamlessly feed into the payroll module, creating a unified and accurate system. This deep integration eliminates the need for manual data transfer between disparate systems, minimizing errors and ensuring that every aspect of an employee's work, from planned shifts and actual attendance to approved time off, is accurately reflected in their pay slip. This holistic approach empowers organizations with a complete and precise overview of their human resources and payroll operations, all within a single, interconnected platform.

Image by Freepik.com

Key Outcomes & Benefits:

Reduce manual processing time 20%,

Odoo Payroll Module has been shown to reduce manual processing time by approximately 20%, leading to a notable increase in HR and payroll team productivity.

This automation minimizes data entry errors and accelerates pay slip generation.

Reduce manual processing time 20%

Odoo Payroll Module has been shown to reduce manual processing time by approximately 20%, leading to a notable increase in HR and payroll team productivity.

This automation minimizes data entry errors and accelerates pay slip generation.

Save 0.5 FTE for Admin Time

Implementation of the Odoo Payroll Module can free up an estimated 0.5 Full-Time Equivalents (FTEs) from routine administrative tasks, allowing HR personnel to focus on strategic initiatives and employee development.

Save 0.5 FTE for Admin Time

Implementation of the Odoo Payroll Module can free up an estimated 0.5 Full-Time Equivalents (FTEs) from routine administrative tasks, allowing HR personnel to focus on strategic initiatives and employee development.

Cost savings of up to 25%

Through reduced manual effort and improved accuracy, organizations can anticipate cost savings of up to 25% annually on payroll processing and associated administrative overhead.

Cost savings of up to 25%

Through reduced manual effort and improved accuracy, organizations can anticipate cost savings of up to 25% annually on payroll processing and associated administrative overhead.

Actionable Insights

The module's robust reporting features, including custom warnings and batch status tracking, provide management with real-time insights into payroll operations, enabling proactive decision-making.

Actionable Insights

The module's robust reporting features, including custom warnings and batch status tracking, provide management with real-time insights into payroll operations, enabling proactive decision-making.

In conclusion, the Odoo Payroll Module offers an all-encompassing solution that empowers organizations to manage their payroll with unparalleled ease and effectiveness, delivering tangible benefits across efficiency, accuracy, and resource utilization.

Description:

The Odoo payroll module is seamlessly integrated with other HR related modules to handle all the payroll needs of your organization. Record the work agreement made with your employee in the dedicated contract section of the payroll module. Decide on which work entry source will be taken into accord to track the days spent at work. Be it through the planning app, attendance app or work schedules set in the payroll app itself. Make sure to choose a carefully preconfigured salary structure that fits the position of the employee.

For each salary structure, salary rules can be configured for each type of wage, allowance, reimbursement, deduction, taxes, social security, bonuses and much more. All customizable.

Carefully follow up on your employees work entries by checking if they match the expected output. Was the employee late, on time or did overtime? Were they on a holiday? Or did they perhaps work a nightshift. Clear any conflicts before generating the monthly pay slips.

Generate monthly pay slips for each individual employee or in batch. Add manual input where needed, create accounting entries, generate tax reports, send out pay slips to employees in bulk and much more.

Dashboard

Warnings:

Odoo has some preconfigured warnings that show up on the warning section of the dashboard. Such as employees that don’t have a contract assigned to them, work-entry conflicts and more.

Custom warnings can be created to warn payroll users on items of action that should be taken. For example, for one of the companies we implemented payroll for, they would like to manually verify each time an employee has worked overtime. Hence we configured a warning rule to pop up on the warning section of the payroll dashboard. Informing the payroll user that an employee has worked overtime and that they should go and verify this.

Technical reference:

# Count all overtime work entries

overtime_entries = self.env['hr.work.entry'].search_count([

('work_entry_type_id.code', '=', ['OVERTIME', 'TOVR', 'TOEOV']),

('state', '=', 'draft')

])

# If there are overtime work entries, trigger a warning

if overtime_entries:

warning_count = overtime_entries

warning_action = 'hr_work_entry.hr_work_entry_action'

Batches:

Displays all the previously generated batches of payslips and their status.

Notes:

A section on which notes can be written that will be visible to all payroll users. This functionality could be used to make company announcements or inform the payroll users of any changes to the legal system that could affect payroll (E.G: SSF is reduced to 3% for the coming three months.)

Contracts:

For the payroll module to be used for an employee. The first thing that should be made sure is that each employee has a running contract configured. If an employee does not have a running contract all the other module data that integrates with the payroll module such as attendance and planning will not be used properly. Moreover, payslips are not able to be generated for employees that do not have a running contract.

- A contract start date is mandatory, but the end date is not. The contract can be manually set to cancelled. Archiving (firing) an employee will also end the contract.

- A working schedule can be set to determine the amount of working hours per week.

- Choose a work entry source, Planning, Attendance, or Work Schedule. Work entries will be based on published shifts, check-ins, or predefined schedules.

Note: Attendance records will override other sources if they exceed the daily average hours set in the work schedule. - A salary structure can be applied to each contract on which individual salary rules can be configured. We will go over more detail on salary structures and salary rules in a later section.

In the wage section of the contract it can be set if the employee has a fixed or hourly wage. Keep in mind that if your employee has a fixed salary, which is more usual here in Thailand you still need a formula on how to calculate the hourly salary in case you need hourly deductions or overtime imbursements.

Furthermore, Odoo studio or custom development can be used to add more custom fields on the contract level according to the needs of the client.

Work Entries:

Depending on which work entry source that is set on the contract, the work entries generated will be collected here on the work entries page. When initially opening the page, a “conflict” filter is set. This is important because if there are any work entries that are conflicting, a pay slip cannot be generated for that employee until the conflicts are resolved. Work entries can be manually added, edited and deleted here.

If manual changes where made to the work entries and you would like to revert back to the standard generations made by Odoo, you can click the “regenerate work entries” button. Please keep in mind that this action is irreversible and that your changes will be undone.

Salary Rules:

Odoo comes with some pre configured salary structures with pre configured salary rules. Don’t be afraid to create your own from scratch, you won’t break the system by doing so. Important to know is that each salary rule has a sequence number. Make sure that you sequence your rules properly so that for example tax is calculated correctly at the end.

You want to take your existing salary structures and rules used in your organization and divide each salary rule into its most basic requirement. For each requirement you can then write a salary rule. If certain salary rules belong to a certain group and will have to be added up or divided as a group you can apply a category to them. Later on in another salary rule you can target the category to get the sum of the salary rules found under this salary rule category.

You can configure the salary rules to take data from the contract level, work entries, employee level or manual entries. Complex tax and overtime calculations can all be made here. Some basic coding knowledge is recommended.

You can configure on each salary rule if you would like the salary rule to be shown as a salary line on the pay slip. You can toggle the rule to not be shown but still be calculated as a whole in the background.

Pay slips:

The final step in the payroll process is the generation of the pay slips. Pay slips can be generated on an individual employee level for a set period of time, or on a batch level for a set period of time. Before confirming, each pay slip can be checked, adjusted and manual inputs can be added.

Once pay slips are confirmed we can then use the generated results to export data into CSV files to create bank transfer files, tax reports and any other reports according to the clients requirements.

Odoo payroll integrated with Thai localisation:

Multiple modules feed data into the payroll module to calculate the amount of days worked, holidays taken, shifts attended, etc…

Odoo payroll in its turn also feeds data into the accounting module. For every salary rule a debit & credit account can be set. When generating a pay slip, first draft entries and after validation those entries can be posted in the proper journal.

With Taube Digital’s Accounting module these Journal Entries are further handled and localized to Thailand for complete compliance to Thai tax laws.

Comparison to other payroll solutions (used in Thailand):

Salary rules and ERP strengths

ERP Strengths: When making a fair comparison between Odoo payroll and other payroll software's such as tiger HR https://tigersoft.co.th/, humansoft https://www.humansoft.co.th, peak account PEAKaccount.com

One has to look beyond the payroll and its related modules. As Odoo is not only a payroll solution but a full blown ERP software it can cover all your operational needs. No matter if you are running a factory, restaurant, import-export business, a service company, etc… Odoo will be able to provide you with an answer to all your companies needs in a single package. Odoo payroll will be able to integrate the employees costs with service products and the manufacturing process. With only a single subscription you will be able to cover your HR needs and more.

Salary Rules: Another feature that separates Odoo payroll from other solutions is its customizable salary rules. Salary rules can be customised into the most minor details. For complicated requirements, python calculations can be coded for each salary rule while targeting variables from every wanted module and menu in Odoo.

Conclusion:

The Odoo payroll module offers a comprehensive and all encompassing solution for your organizations HR and payroll needs. Most functionalities are ready to be used and can be augmented by minor customizations.